Claim your deductionsĭeductions from your total income reduce your taxable income. The sum of all income sources is your total income.

Rental real estate, royalties, or income from a partnership, C corporation (not included on a Schedule 1) or trust (in which case you’ll also need to complete Schedule E).

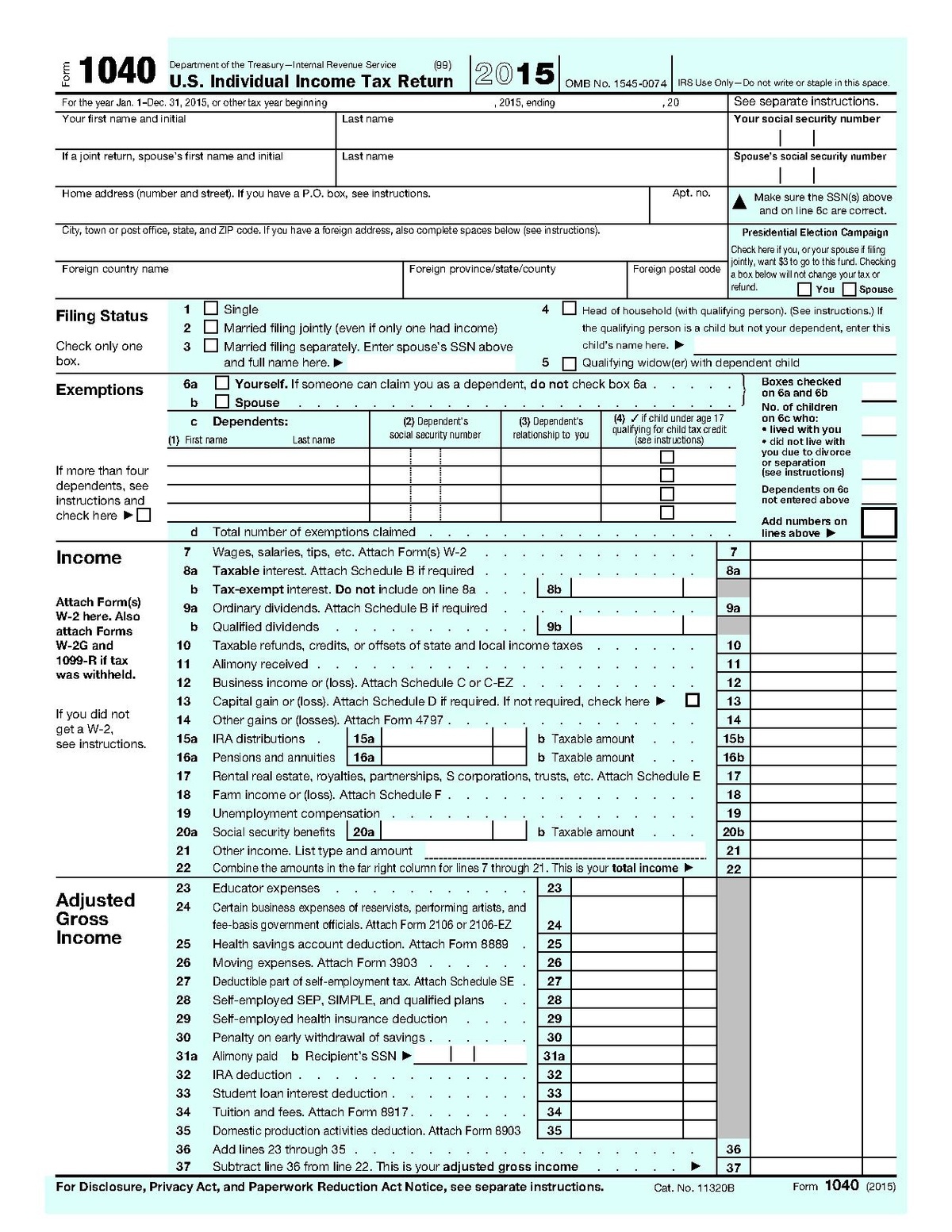

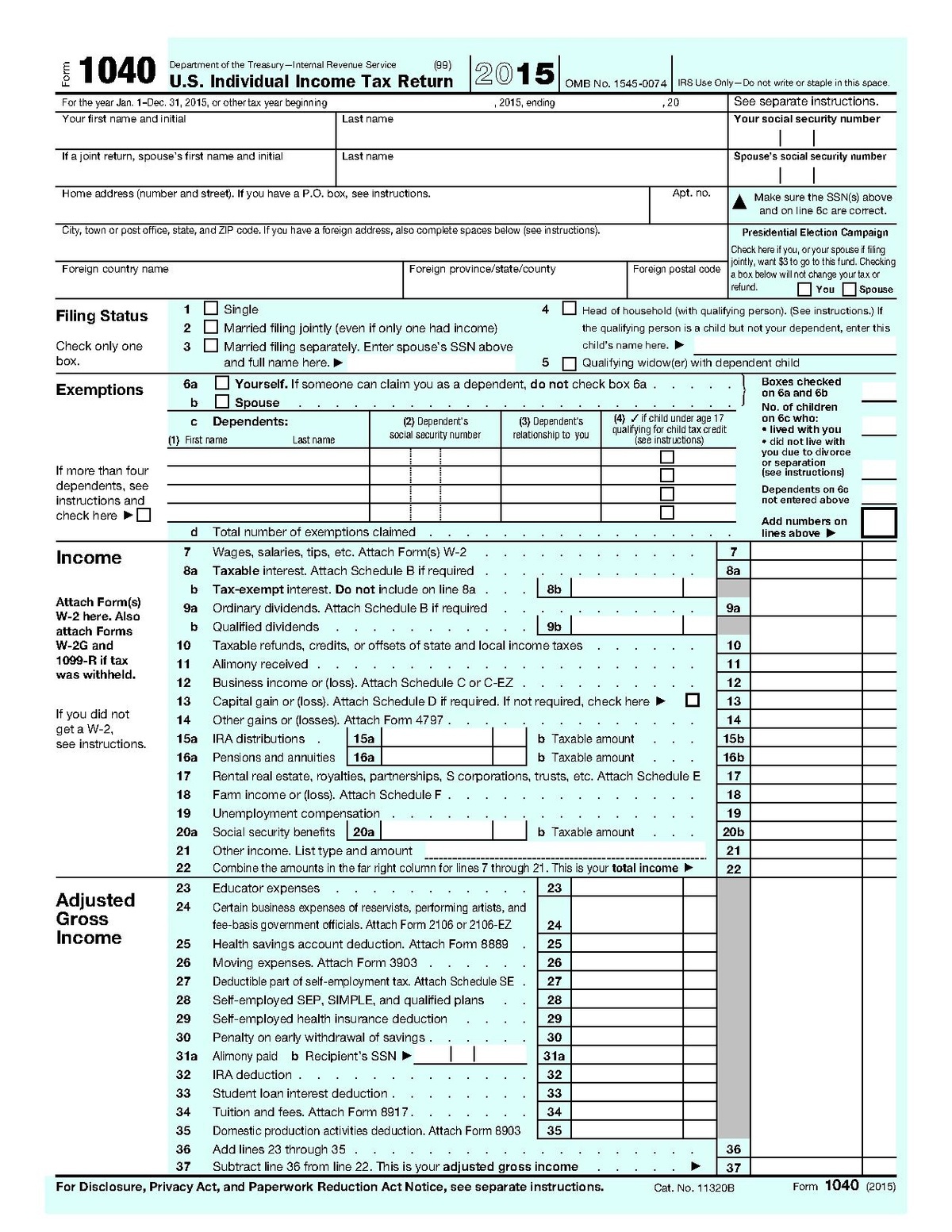

Gains or losses from sales of business property. Business income (in which case you’ll also need to complete Schedule C). Alimony from a divorce decree before 2019. If you have any additional income sources, you’ll also need to complete Schedule 1 to report: Lines for many common types of income, such as wages, interest and dividends, retirement income, and capital gains are provided. Then you’ll move on to report all sources of income you received for the year. On the first page of Form 1040, you’ll provide your (and your spouse, if married) name, Social Security number, address, and information on your dependents. If you plan on doing it yourself, read on. However, taxpayers age 65 and up may be able to file using Form 1040-SR. The IRS now requires most taxpayers to use Form 1040. These were Form 1040EZ and 1040A, but they no longer exist. What about 1040EZ and 1040A?īefore 2019, there were shorter versions of Form 1040 for filers with simpler returns. That means most independent contractors, freelancers, and business owners have to file Form 1040, even if they don’t meet the gross income thresholds shown above.įor more advice on who needs to file, check out Chart A, B, and C in the Instructions for Form 1040. However, if you have net earnings of at least $400 from self-employment, you must file a tax return.

Gains or losses from sales of business property. Business income (in which case you’ll also need to complete Schedule C). Alimony from a divorce decree before 2019. If you have any additional income sources, you’ll also need to complete Schedule 1 to report: Lines for many common types of income, such as wages, interest and dividends, retirement income, and capital gains are provided. Then you’ll move on to report all sources of income you received for the year. On the first page of Form 1040, you’ll provide your (and your spouse, if married) name, Social Security number, address, and information on your dependents. If you plan on doing it yourself, read on. However, taxpayers age 65 and up may be able to file using Form 1040-SR. The IRS now requires most taxpayers to use Form 1040. These were Form 1040EZ and 1040A, but they no longer exist. What about 1040EZ and 1040A?īefore 2019, there were shorter versions of Form 1040 for filers with simpler returns. That means most independent contractors, freelancers, and business owners have to file Form 1040, even if they don’t meet the gross income thresholds shown above.įor more advice on who needs to file, check out Chart A, B, and C in the Instructions for Form 1040. However, if you have net earnings of at least $400 from self-employment, you must file a tax return.

In general, you must file a Form 1040 if: Your filing status is. need to file Form 1040 no matter if they are self-employed, work for someone else as an employee, or live off income from investments.

0 kommentar(er)

0 kommentar(er)